The digital economy is forecast to grow almost twice as fast as global GDP by 2028. This article analyzes the leading digital economies and the key sectors driving this upswing, based on data from the World Economic Forum and Forrester’s Global Digital Economy Forecast.

The World Economic Forum estimates that more than two-thirds of new value creation over the next decade could come from digitally enabled platforms. Forrester’s new Global Digital Economy Forecast measures the size and growth of the digital economy in areas such as technology spending, retail, travel e-commerce, insurance e-commerce, exports of information and communication technology products and services, chip manufacturing and data centers.

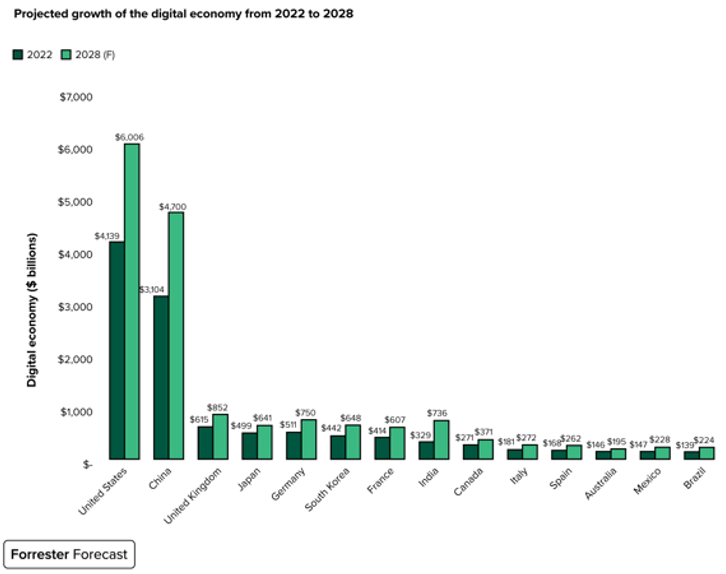

The six largest digital economies by size are the USA, China, the UK, Japan, Germany and South Korea (see image). According to the report, the digital economy will record average annual growth (CAGR) of 6.9% from 2023 to 2028, growing faster than global GDP.

The digital economy is driven by:

- E-commerce, technology spending and exports. Online retail and travel will increase their share of the digital economy, with a compound annual growth rate (CAGR) of 9% and 7% respectively from 2023 to 2028. Technology spending is the main contributor to the digital economy in France, Italy, Spain, Canada, Brazil, the US, the UK, Japan and Germany. European companies with higher value business activities, higher digital maturity and advanced cybersecurity adoption tend to invest more in technology. Investment in software in Europe also drives higher value-added activities, as does the concentration of ICT specialists in the workplace, which correlates with the digital maturity of companies. Exports of ICT products and services account for the largest share of the digital economy in India, South Korea and Mexico.

- The USA and China. Almost two thirds of the global digital economy comes from the USA and China. The US, with 4.2% of the world’s population and 26% of global GDP, accounts for 42% of global technology spending. E-commerce accounts for the largest share of the digital economy in China, with 39% of retail sales made online in 2024, rising to 41% by 2028.

- Expenditure on digital research and development (R&D). A country’s R&D spending as a share of GDP correlates with the digital economy’s share of GDP. South Korea spends the largest share of its economy on R&D, with focused investments in AI, semiconductors for AI, 5G and 6G, quantum computing, metaverse and cybersecurity. The Indian government has launched Digital India futureLABS to boost R&D and innovation investments. In Europe, digital investment is lagging behind, with average growth in technology spending per year from 2024 to 2027 expected to reach €83 billion, well below the €125 billion required by the European Commission to meet digital growth targets.

- Digital companies. Forrester estimates that valuing free digital goods (such as Facebook, Twitter, Google Search, Google Maps, YouTube) would further increase the size of the digital economy by around 25%. Large companies are driving digital business revenue; e-commerce accounted for 18% of business revenue in the European Union in 2022, rising to 23% for large companies but reaching only 11% for SMEs.

- New trends in data centers and chip production. Trade conflicts are leading to a shift in semiconductor production from regions such as Taiwan to domestic markets. TSMC predicts that shifting chip production to the US could increase costs by up to 50%; currently, US chip production covers less than half of domestic demand. The European Union plans to double its chip production by 2030 to capture a 20% share of the global market. Data centers are increasing their share of the digital economy: NTT forecasts that spending on colocation data centers will grow by an average of 13.5% annually from 2023 to 2028, reaching USD 138 billion by 2028, and Huawei predicts that data centers will increase their computing power by two orders of magnitude by 2030.

Technology investment: Focusing on the growth of the non-digital economy

Despite the growth of the digital economy, the majority of a country’s GDP is driven by non-digital activities or by more subjective, non-monetary measures of technology investment such as customer experience metrics and employee productivity. Therefore, technology investment will focus on influencing non-digital activities in order to:

- Optimize customer satisfaction and digital impact. Only a small proportion of large global organizations that report CX metrics are believed to link them to financial outcomes. 47% of banking decision makers plan to use generative AI to increase digital influence. Forrester predicts that by 2024, 39% of US retail sales will come from the digital influence of offline sales. Europeans place a high value on travel; more than 50% of adults online in Spain, Italy, Germany and the UK said they enjoy traveling in their free time. As travel becomes more sustainable, travel companies will use digital influence to promote less-visited destinations and the use of public transportation, as well as eco-certified hotels and resorts. 44% of Germans said they would prefer to buy products from climate-conscious companies.

- Increase productivity in the workplace. Although U.S. technology companies are seeing significant productivity gains, particularly in software, data processing and computer system design, the correlation between technology spending and productivity growth is low across industries; ICT capital requires a skilled workforce and the adaptation and rethinking of business processes that take time to impact business productivity metrics.

- Digital governance and fair distribution of economic benefits. Profits from the digital economy are not evenly distributed. E-commerce platforms are dominated by Amazon, Tmall, JD and Pinduoduo, and large providers such as Microsoft, Amazon, Oracle and SAP capture a significant share of the global software market. The EU is driving digital governance through the Digital Markets Act to prevent gatekeeper platforms from imposing unfair conditions on businesses and consumers.

To foster the growth of the digital economy, countries need to focus on digital businesses, public services, the availability of digital skills, the growth of R&D spending and technology investments that impact non-digital activities. Forrester’s Global Digital Economy Forecast 2023 to 2028 shows that the digital economy will reach $16.5 trillion by 2028 and capture 17% of global GDP across 14 countries in North America, Europe, Asia-Pacific and Latin America.