Sorting receipts, filing documents, maintaining Excel spreadsheets: In 10 years’ time, these routine activities will hardly play a role in the AI-influenced everyday life of accounting. What does this change mean for the job profile? What opportunities and risks will arise?

AI or file folder? Digital or manual?

Twenty years ago, Maria worked in a small office full of piles of paper and files. She sorted, filed, processed payslips with a calculator and manual spreadsheets. In the near future, Maria’s everyday life will be different: Maria sits in a modern office in front of a sleek laptop and does the bookkeeping together with an AI-supported assistant that takes over the routine work. Deep learning algorithms learn independently and become more precise and reliable with each run. Maria only gives short voice commands and checks the results provided by the AI. There is time to take care of setting up the next report.

Even today, the commercial department is already a strategic partner of the management and operates in a state between AI, full automation and manual tasks. Reminder proposals, open items, invoice processing: never before have so many tasks been almost completely automated.

Making AI an ally in good time

Artificial intelligence will soon be able to operate more and more independently in commercial areas. There is no longer any sign of the initial fear that human work areas could be eliminated. Artificial intelligence is becoming much more of a team member in tandem with humans. It takes over error-prone routines such as the allocation of data in accounting processes and the like, draws attention to discrepancies and errors, and encourages human revision. AI-supported software uses its strengths to analyze complex financial data and identify patterns. Variance analyses are used to identify deviations between planned and actual results and investigate their causes.

Experts call this prediction of events based on experience learned from the commercial department’s database predictive analytics. This scenario will also become a reality in commercial departments in the medium term. What will the team of HI (Human Intelligence) and AI (Artificial Intelligence) achieve in the future?

This puts management in a position to take proactive improvement measures. In the commercial area, Maria and her team are pleased with the predictions on payment behavior and dunning behavior among creditors. It’s not just the technology that is changing, but also the people. The transition from pure data entry by accountants to analytical tasks is what makes it possible for commercial departments to contribute to value creation in the first place. Together with people, AI in accounting definitely has the potential to become a firm pillar in a company’s value creation – and thus contribute to the company’s success in the long term.

Study: Many companies lack robust digital strategies

But what is the reality today? This much in advance: the first steps have been taken. Artificial intelligence does not knock on the door and want to be let in. In addition to technical infrastructure, this is also an important development topic for employees. A recent survey conducted by Diamant Software GmbH, an accounting and controlling software specialist from Bielefeld, Germany, with 332 participants shows that most companies are currently operating in a digital gray area.

Although data and analytical knowledge is recognized as the competence of the future in the commercial sector, there is often a lack of robust digital strategies. For example, only 34.9% of respondents are satisfied with the use of workflows that have already been digitized. There are many reasons for this. Technologies are often not optimally integrated into the company. Many companies continue to lose time because specialist departments such as accounting and controlling are not networked on the software side and the merging of information requires manual work, which impairs productivity. In addition, employees are often inadequately trained or do not feel internally prepared for the digital transformation in their day-to-day work.

An IHK survey on digitalization in 2023 reveals a similar problem. Companies often struggle to keep up with the rapid pace of development. There is a lack of time and financial resources as well as IT specialists to manage the complex AI technologies, which often require a certain level of specialist knowledge. There are also complex regulatory requirements and security risks when it comes to data protection. Many companies therefore only rate their level of digitalization as “satisfactory”. The good news is that AI systems for accounting will be able to be integrated more and more smoothly into existing IT landscapes and operated more intuitively in future. This development should take pressure off the boiler.

Artificial intelligence makes suggestions – humans decide

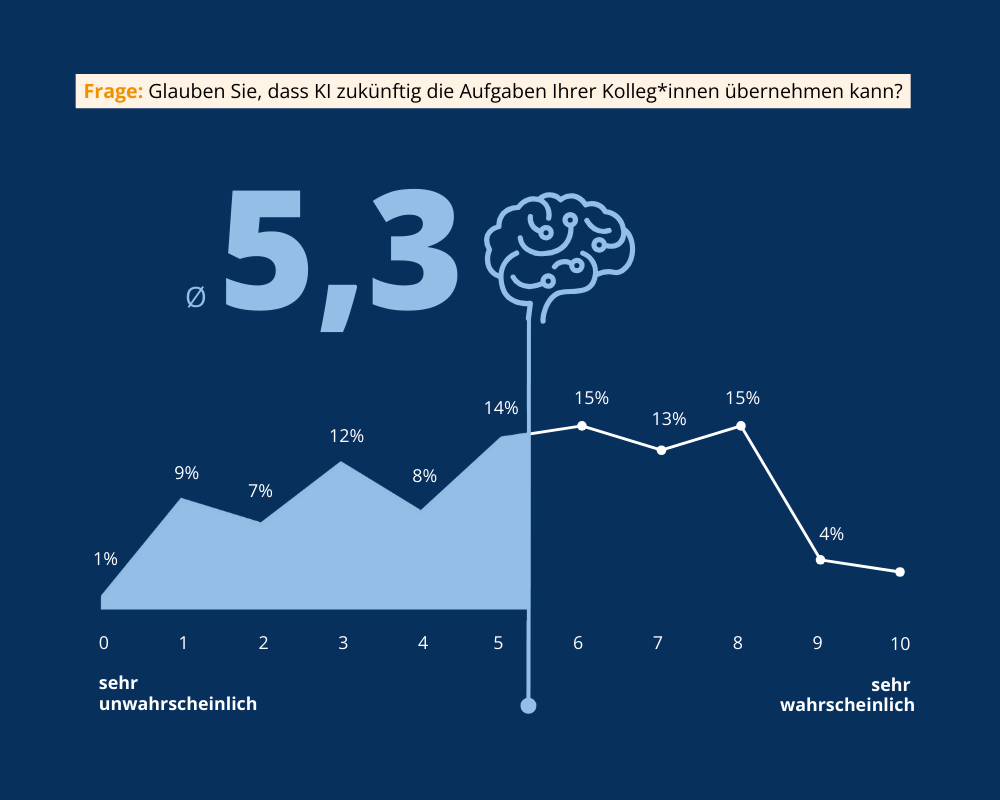

A year ago, a study by Diamant Software revealed acceptance problems with AI in commercial areas. Where is the data stored? How secure is company data in the cloud? Do employees have to worry about their jobs? Only 10% of the companies surveyed trusted AI software to summarize reports and analyses, for example. 48.8% would prefer an automatic suggestion function that is then approved by a human employee. humans should continue to play a key role in the processes. For example, suggestions for account assignment would be made by the software, but these would have to be approved by a person.

Complete automation by software, especially for critical tasks such as the preparation of financial statements, appears to be less attractive for companies in the future. Only 13.3% can imagine financial statements, including consolidation, being prepared entirely by software. In less critical areas such as invoice entry, 46.9% are aiming for complete automation through software. So there is still a lot of potential that has not yet been exploited. Today, the figures would certainly paint a very different picture – because the reasons for the lack of acceptance are in the process of disappearing.

Conclusion: companies must set the course for the future of AI now

The advent of AI does not necessarily mean that accounting jobs will be lost. However, the accountant of 2030 will be far more than just a data entry clerk. They will need to have a wide range of new methodological and technical skills that hardly played a role in their old professional world. These skills will turn her into an analyst who works closely with AI-supported software and supports management in making strategic decisions. This shift in priorities is anything but new. But the transformation is now clearly gathering pace. Companies must pave the way for this transformation of the job profile by developing resilient digital strategies in good time, driving forward the integration of AI technologies into their IT systems, investing in employee training and providing psychological support for the change.