Centralized digital identity systems have had their day – they are vulnerable to attacks, cost-intensive and rob users of control over their data. Technical Evangelist Debanjali Ghosh explains how blockchain technology is revolutionizing the management of digital identities.

In a world where interactions are increasingly digital, it is necessary to take a close look at how digital identities are managed and protected. The approaches widely used in the past to achieve this are now facing major challenges that pose significant risks to both individuals and organizations. Centralization of data, a reliance on third-party verification, rising costs and a high level of complexity in ensuring compliance are just some of these challenges. The concept of blockchain-based identity has emerged as an alternative with significant potential – an alternative that will fundamentally change the way we understand, manage and protect digital identities.

The latent weaknesses of conventional approaches to digital identities

Current approaches to digital identities are based on centralized architectures where a single institution or organization is responsible for collecting, storing and managing user data. While this approach has led to significant growth in online services and optimized access to them through unified identity management, it also has significant drawbacks.

One of the biggest challenges currently facing digital identity management is that centralized data systems are particularly vulnerable to attack. If all user data is stored in a single consolidated location, this location becomes an attractive target for cyber criminals. In large-scale incidents such as the 2017 attack on the US credit bureau Equifax, the personal data of millions of people is compromised simultaneously – just one example of the significant risks of centralized data storage.

In addition, compliance processes such as Know Your Customer (KYC) and Anti-Money Laundering (AML), which are particularly important for highly regulated industries such as the banking sector, are often time-consuming, cost-intensive and error-prone. If it is necessary to perform identity checks over and over again across different platforms, this is not only a cost factor, but also inefficient and a sign of a user experience that is not focused on the user.

Last but not least, centralized systems also ensure that users lose control over their personal data. Every time they create an account or share information online, they relinquish some control over how this data is used, stored and shared. This loss of control over their own data is a problem in terms of data protection law, as individuals often simply have no influence over how their data is monetized or who gains access to it.

Self-determined digital identity: a game changer in terms of digital autonomy

Information that is relevant to one’s identity – such as a driver’s license or student ID – is usually managed by the institutions that issue it. When their owners use them online, they often lose complete control over how this personal data is used. A simple example: When a person logs into a website with their email address, from that point on, the website knows that email address and has some degree of control over it.

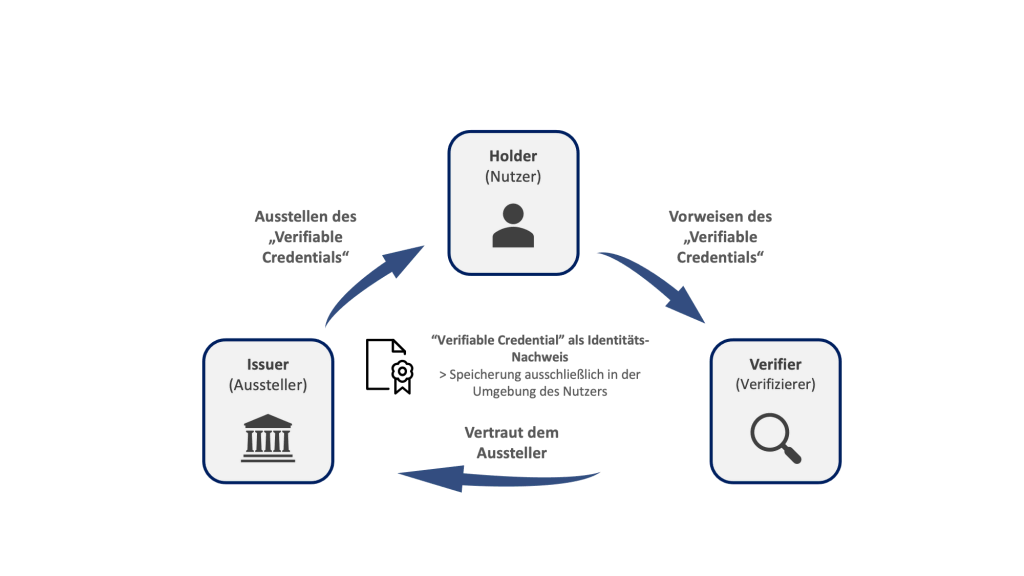

Self-Sovereign Identity (SSI) is based on the idea that individuals should have full control over their digital identity. It uses blockchain technology to give users back this control over their data. Instead of letting companies or governments manage their digital identity, the SSI approach allows personal data to be stored in a secure digital wallet on the blockchain. This allows users to decide for themselves what information is shared with whom. They can thus ensure that their privacy and security are maintained.

The blockchain is comparable to a digital notebook, of which each person has a copy. When one person writes something in it, the entry is automatically added to every other person’s copy to ensure that everyone has the same, up-to-date information. Or to put it more simply: blockchain creates a shared, secure documentation of transactions.

The decentralized nature of blockchain ensures that, unlike centralized approaches, there is no single point of failure. The data stored in the blockchain is also immutable, i.e. it cannot be manipulated or falsified, which significantly reduces the risk of fraud and identity theft. And the cost and efficiency benefits of the SSI approach are also significant: reusable digital identities mean that processes such as KYC can be streamlined. Blockchain technology can therefore significantly reduce the time and costs involved in verifying digital identities. This efficiency gain is particularly valuable in industries with strict compliance requirements, as it provides a faster and more reliable way to meet regulatory requirements.

Using the blockchain for identity management

The potential of the SSI approach is not only enormous in theory. SSI is already being used in practice in various scenarios. The country of Bhutan, for example, has introduced a so-called National Digital Identity (NDI) system based on the SSI approach as part of its Digital Drukyul Flagship Program. This system allows individuals to manage their own personal data and digital identities while enabling secure digital interactions between the government, citizens and companies in the private sector. It is also possible to issue verifiable certificates (VCs) via decentralized identifiers (DIDs). The example of Bhutan shows how SSI can improve the framework conditions for digital identities even at a national level.

Similarly, the Farmsent project, a global blockchain ecosystem for the agricultural industry, uses blockchain to simplify digital identity management for farmers, enabling them to gain easier access to capital and conduct secure digital transactions. To this end, non-fungible tokens (NFTs) are used instead of traditional bids in auctions for agricultural products in order to guarantee the authenticity of transactions and ensure the credibility of buyers and sellers. This innovative use of blockchain technology shows how SSI can support disadvantaged groups worldwide and optimize industry-specific processes.

Both examples illustrate the broad applicability of the SSI approach in various sectors, from government services to agriculture, and underline the potential of blockchain as a driver of secure, efficient and inclusive digital identity solutions.

The challenges of blockchain use – and how they can be overcome

Despite its inherent potential, the introduction of blockchain-based identity management is not without its challenges. Scalability is one of the bigger challenges, as blockchain networks must be able to handle an ever-increasing volume of transactions, ideally without compromising performance. However, there are also regulatory hurdles: Particularly in regions with strict data protection laws, these are often an obstacle to the widespread acceptance of blockchain technology. In addition, blockchain technology can be complex and therefore daunting for many users who are not familiar with it, which makes acceptance and therefore the development of new interfaces more difficult.

However, as technology matures, these challenges are likely to be gradually overcome. The combination of blockchain technology and cybersecurity, coupled with the advances made in the deployment of decentralized technologies in recent years, is enabling a new era of digital identity that focuses on user sovereignty, data integrity and security.